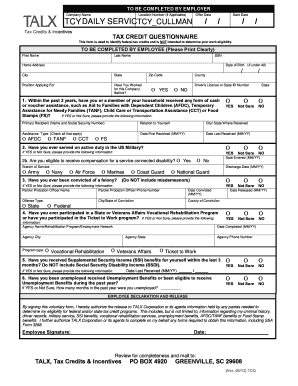

work opportunity tax credit questionnaire on job application

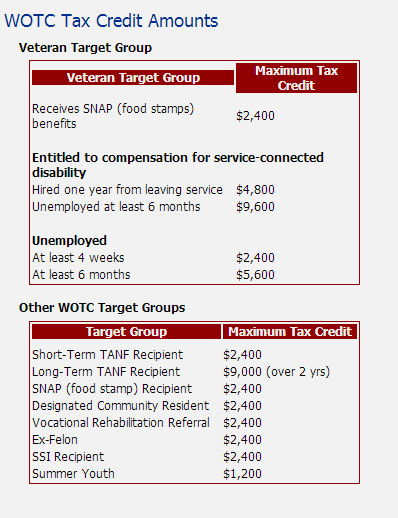

Thank you for your participation. To provide a federal tax credit of up to 9600 to employers who hire these individuals.

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

It is one of the ways they can verify your identity.

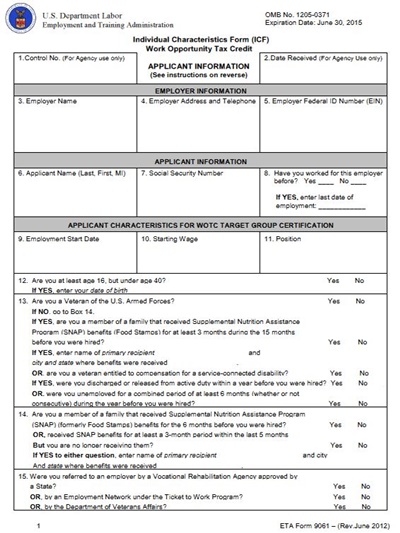

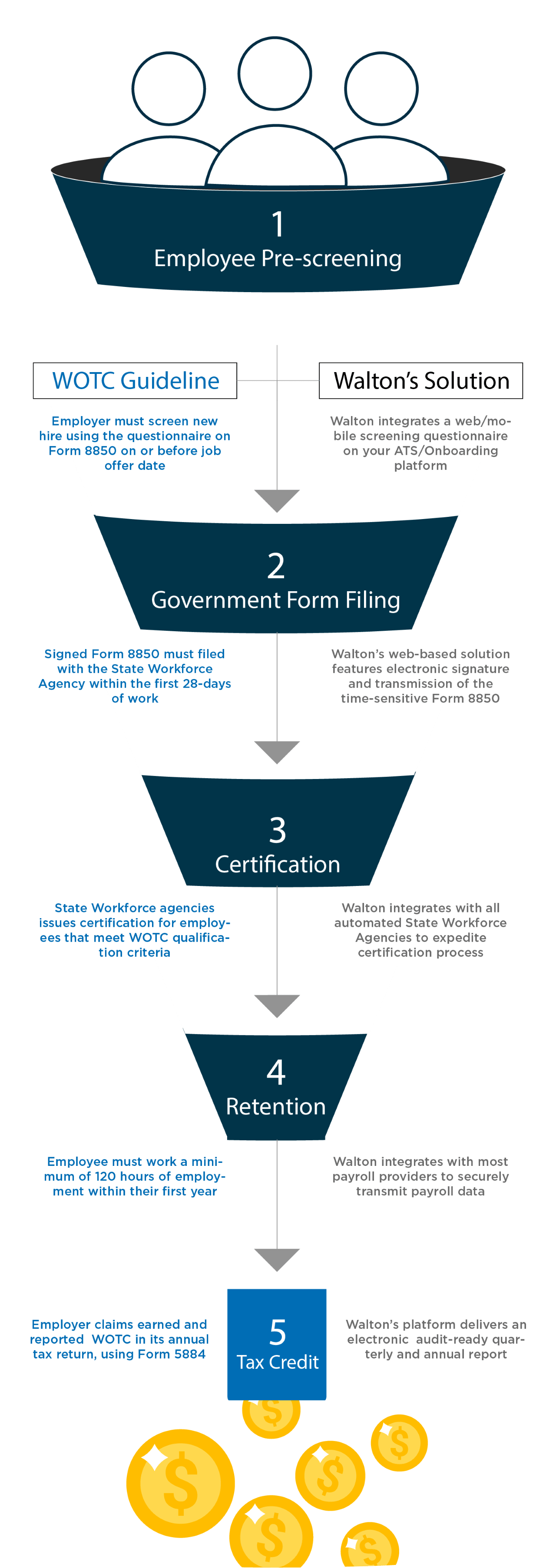

. Complete page 1 of IRS Pre-screening Notice and Certification Request for the Work Opportunity Credit Form 8850 when the job offer is made. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to submit WOTC Request for Certification applications and to view and manage submitted applications. The Work Opportunity Tax Credit.

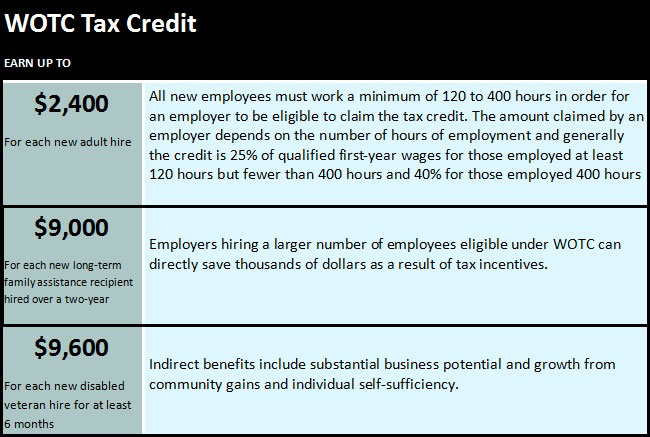

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Full WOTC credit requires 400 hours of work. WOTC Applicant Survey Compass Group is participating in the Work Opportunity Tax Credit WOTC program.

Employees in the TANF recipient category must work 400 hours. Fill in the required fields that are colored in yellow. Tax Credit Services 651 Boas Street 12th Floor Harrisburg Pa.

Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit. Partial WOTC credit requires at least 120 hours of work but less than 400 hours. The data is only used if.

This progwill not affect anyram hiring decisions. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. For instance it would be material for a bank job fiduciary position where you are responsible for other peoples assets or law enforcement.

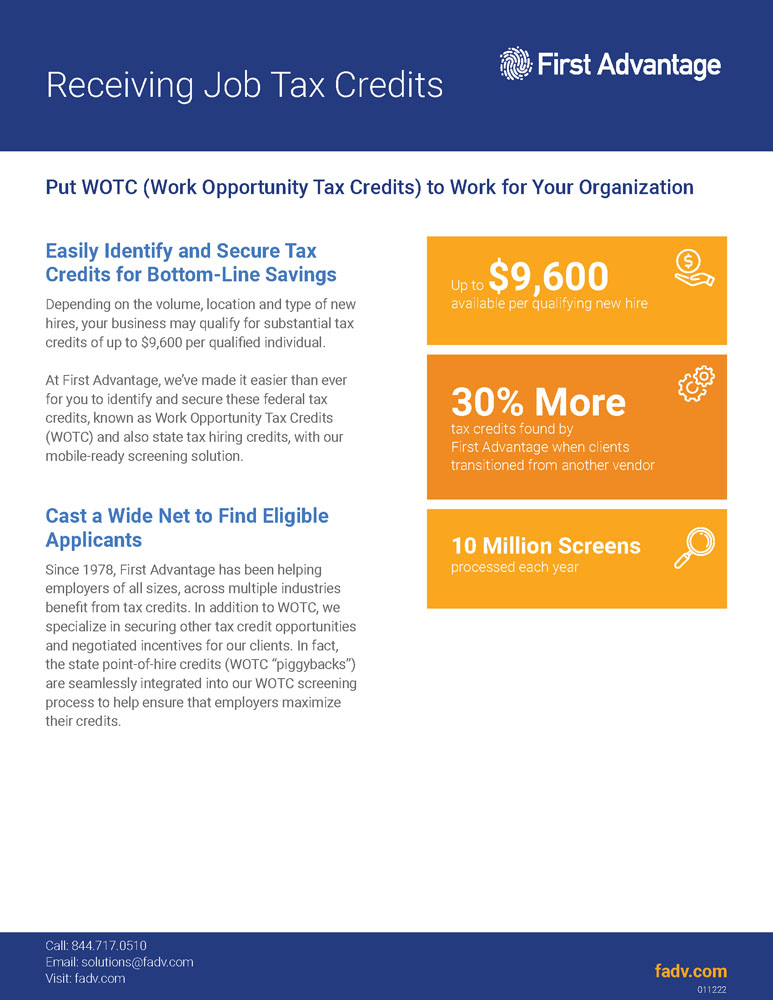

Go to the e-signature tool to add an electronic signature. Affected employers and consultants submitting WOTC related IRS form 8850 for their new hires in declared disaster zones or other storm affected. Through the Work Opportunity Tax Credit WOTC Program employers have the opportunity to earn a federal tax credit between 1200 and 9600 per employee.

EWOTC increases efficiency in processing new applications and decreases the. Calculate 25 of wages earned up to 14000 wage cap 3500 maximum credit allowed. There are two sets of frequently asked questions for WOTC customers.

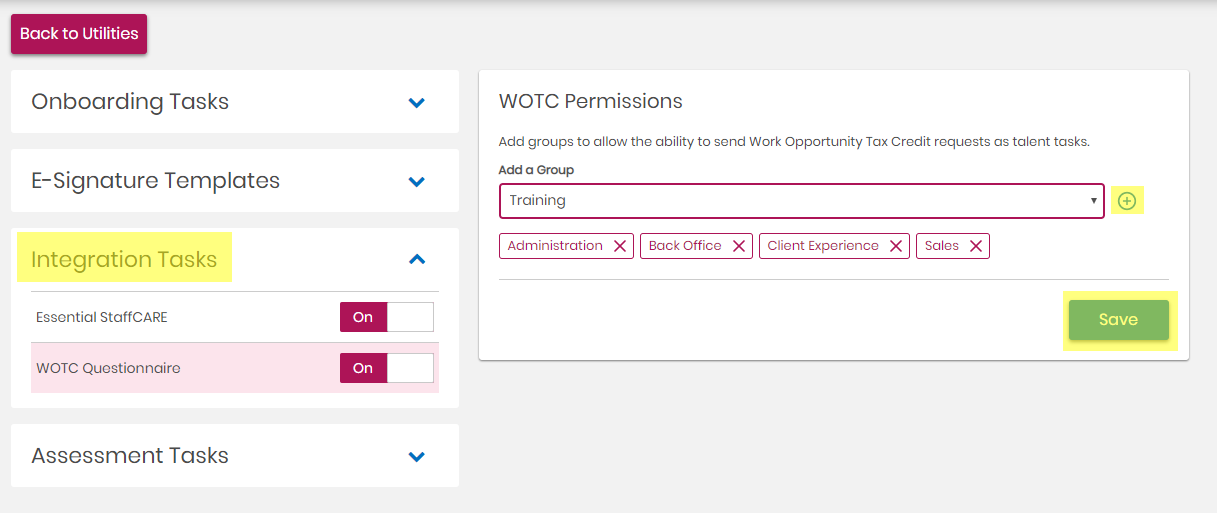

You can give the information or decline to identify yourself because these. You can encourage employees to complete the WOTC screening form by including WOTC with your onboarding documents and providing the new employees with instruction example verbiage below. This tax credit is dependent upon the new employee qualifying as a member of one of the below target groups and working a minimum of 120 hours in their first year.

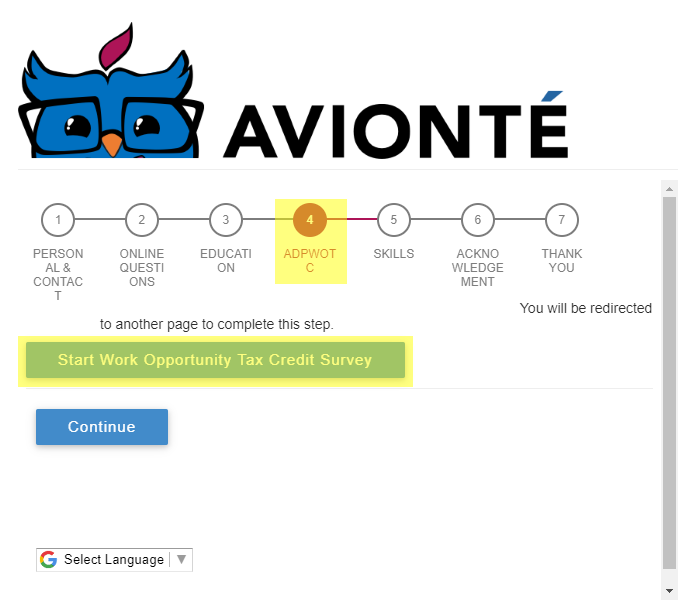

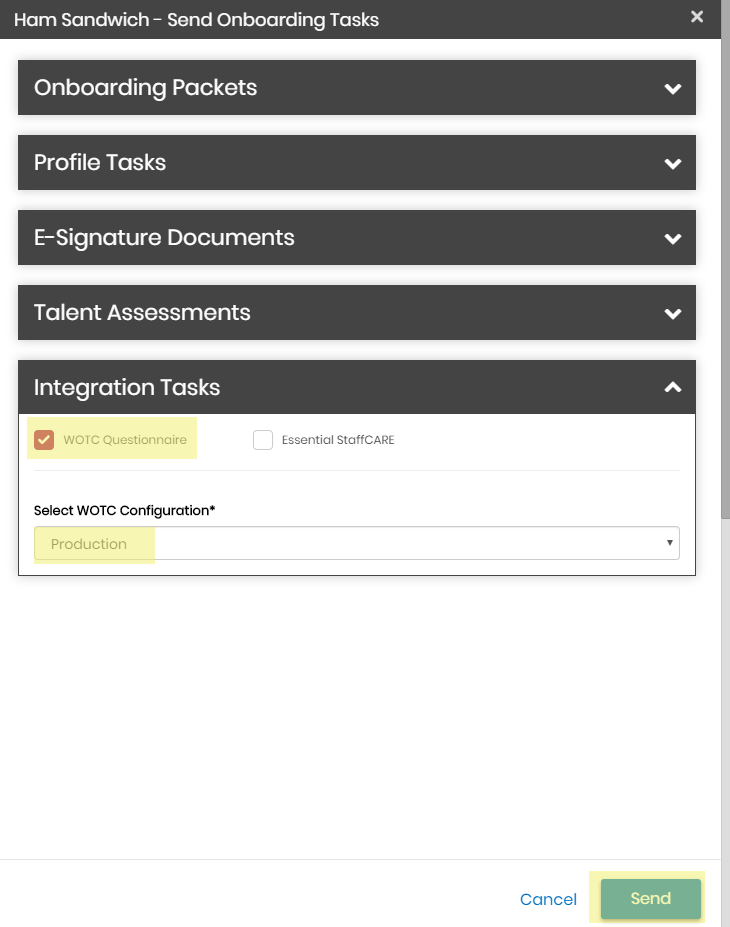

Sign in to your talentReef applicant portal to complete the questionnaire. This program is designed by the federal government to help companies hire more people into the workforce and to retain employees through federal incentives. WOTC is a voluntary program participation is optional and employees are NOT required to complete any WOTC paperwork or forms you provide.

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. What is ADP tax credit screening. The answers are not supposed to give preference to applicants.

In qualifying individuals for the WOTC. A Federal Business Tax Credit for Iowas Employers About The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire eligible individuals from target groups with significant barriers to employment. This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training.

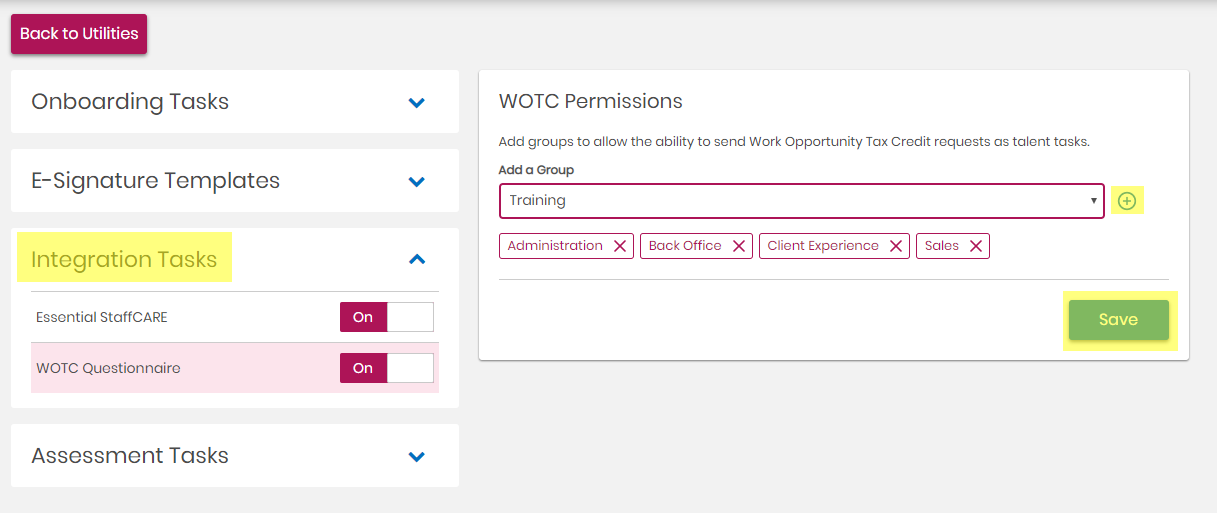

If youre hired with a company who utilizes the WOTC after hire you will be asked to complete the questionnaire as part of the new hire onboarding process. Name _____ Date of Birth_______________. Complete page 2 of IRS Form 8850 after the individual is hired.

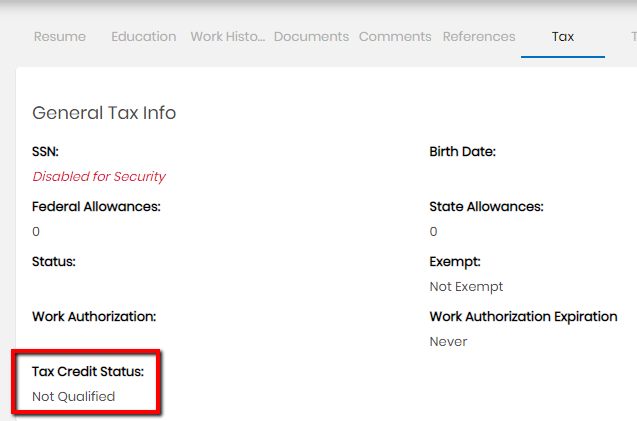

Work Opportunity Tax Credit WOTC Frequently Asked Questions. Open the template in our full-fledged online editor by clicking Get form. The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow.

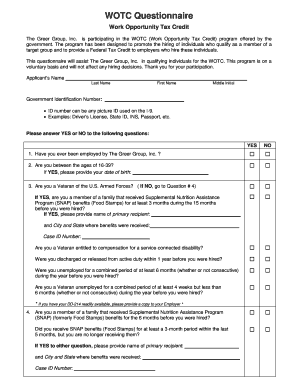

ADPs new mobile tax credit screening helps companies reduce the time and resources needed to determine. Private Sector and For-Profit Business Tax Credits If you are a private sector or for-profit business you may be eligible to earn tax credits. This questionnaire will assist KS Staffing Solutions Inc.

Use IRS Form 5884 when filing annual tax returns to claim the WOTC. If you are unsure how to do this learn how to view your onboarding tasks and how to complete them. Federal Tax Credit to employers who hire these individuals.

Maximum tax credit is 5600 per new hire. WOTC-certified employees must work at least 120 hours during the first year of employment for an employer to claim credits which are calculated as a percentage of qualified wages. Calculate 40 of wages earned up to 14000 wage cap.

Each year across the United States employers claim more than 1 billion in tax credits under the WOTC program. A voluntary questionnaire seeking EEO data asks you to identify your race ethnicity sex veteran and disability status. After the required certification is secured taxable employers claim the WOTC as a general business credit.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. Questions and answers about the Work Opportunity Tax Credit program. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

If they are specifically asking for a credit check it depends on the position and company of whether that is a legitimate requirement. WOTC is a Federal tax credit available to employers for hiring individuals from specific. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been on food stamps ex.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. Hit the arrow with the inscription Next to move on from one field to another.

Consultants requesting the Work Opportunity Tax Credit WOTC affected by the recent storms tornadoes and floods hitting the state of Texas. The Workforce Opportunity Tax Credit WOTC program can reduce your cost of doing business while helping job seekers find and retain good jobs.

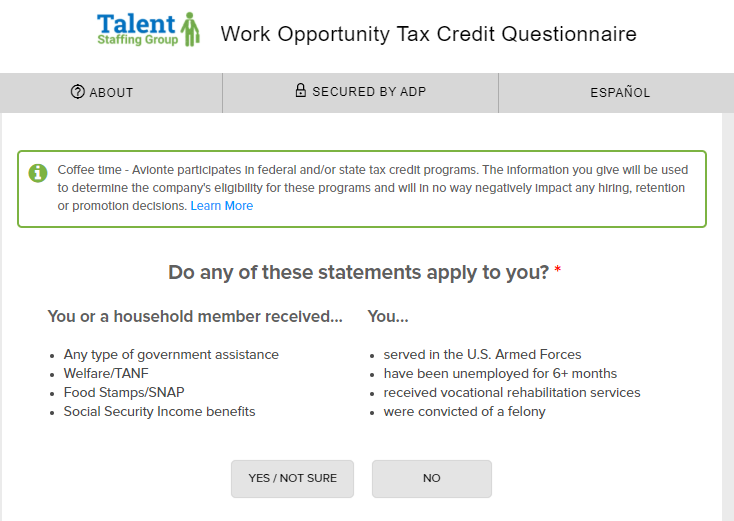

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

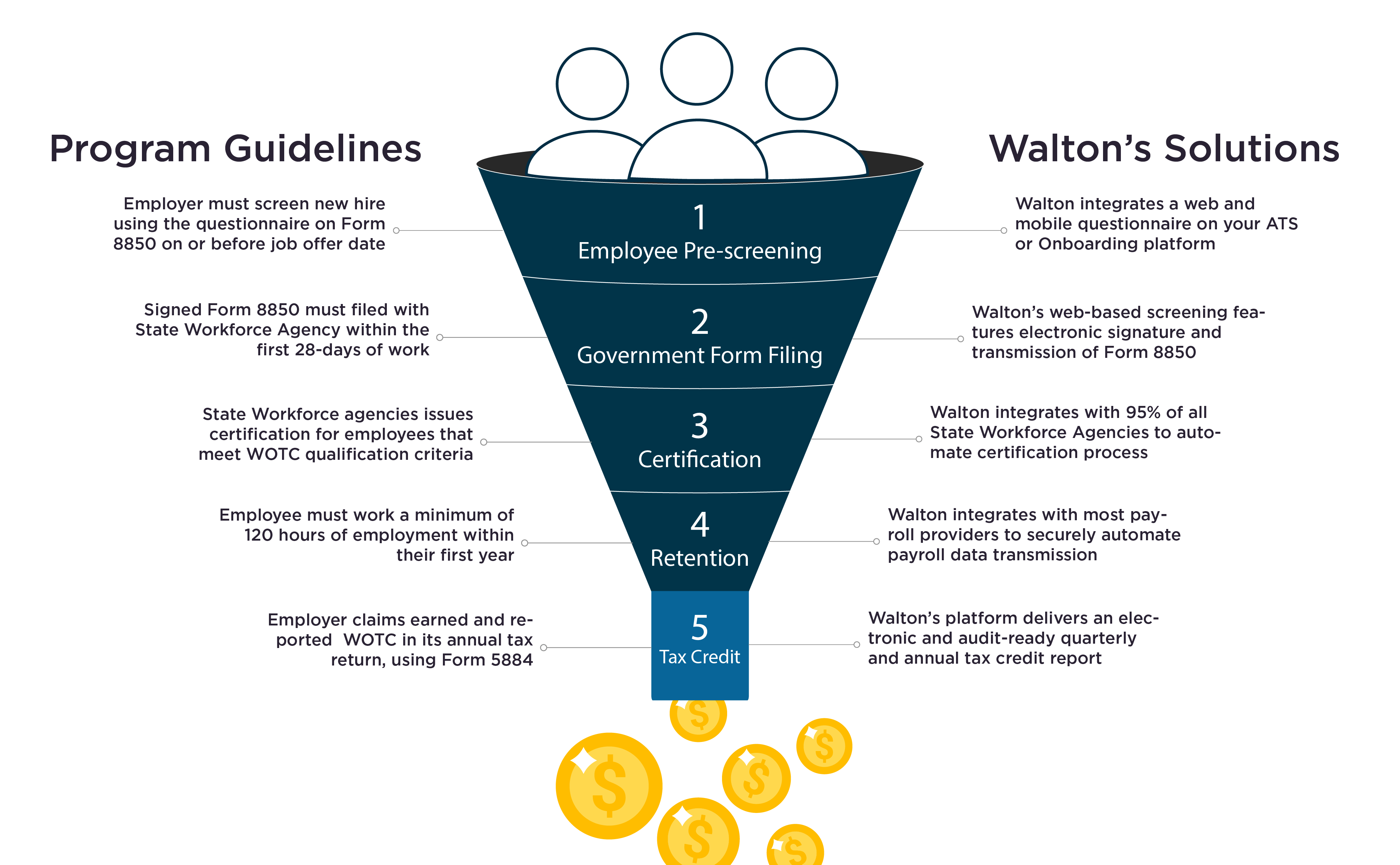

Work Opportunity Tax Credits Wotc Walton

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit First Advantage

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credits Wotc Walton

Completing Your Wotc Questionnaire

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts